Uniqueness

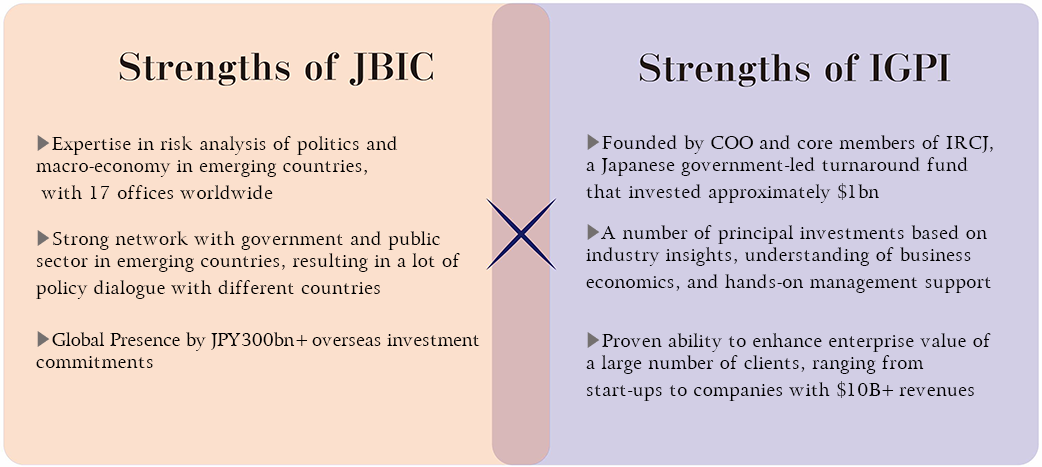

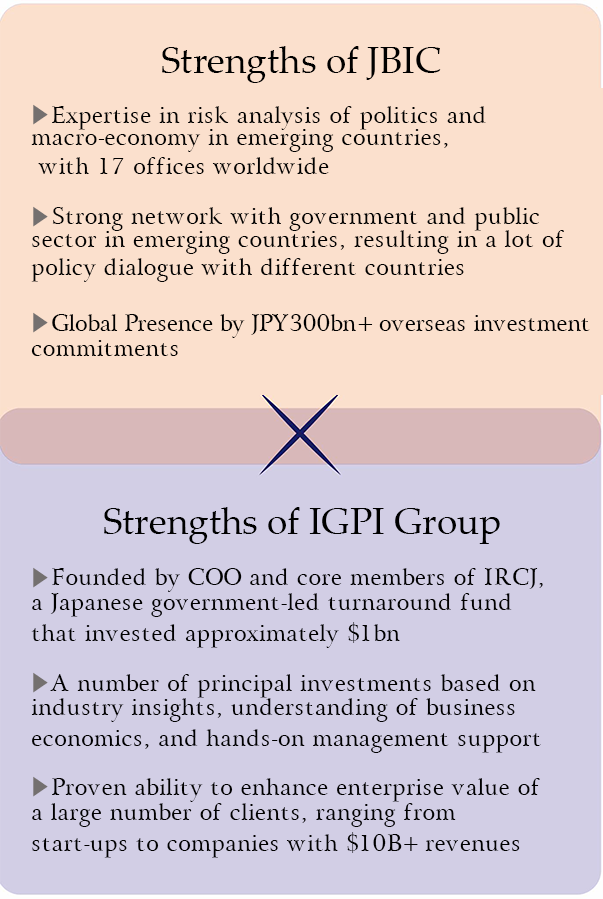

JBIC IG Partners provides various fund-related services on overseas investment funds by capitalizing on the respective strengths of our shareholders, JBIC and IGPI Group.

JBIC and IGPI Group have a track record of carrying out large and small investments for various industries, in both developed countries and emerging economies. Please see here for investment by JBIC, here for investment by IGPI Group.

Business Model

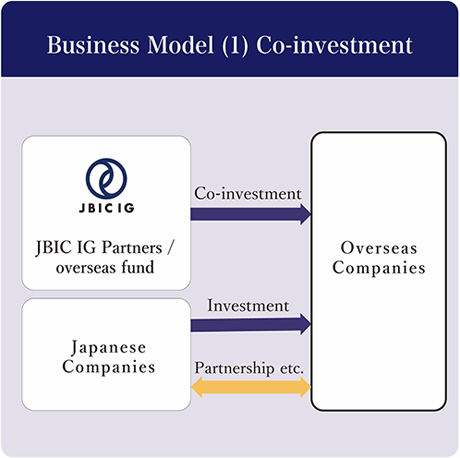

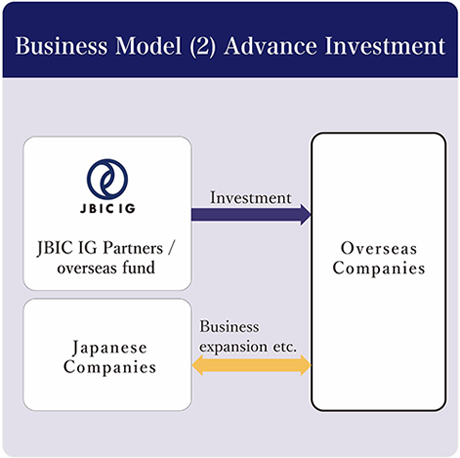

Through investment advice to overseas funds, we will invest in overseas companies as a JBIC IG group.

-

We jointly invest in overseas companies and share risks with Japanese companies,

-

We invest in overseas companies and aim to expand transactions with target companies and Japanese companies.

Fund

As a JBIC IG group, we compose overseas funds by partnering with foreign sovereign wealth funds (SWF) and international investors. JBIC IG Partners provides various services to such overseas fund.

As a guiding principle, we advocate the following investment policies for individual investment.

Investment Target

The targeted asset classes are mainly venture, growth and buyout, and we conduct equity investment in companies.

Investment Period

To aim for value creation based on a long-term perspective, we expect to exit after, at maximum, seven years from investment.

Exit Strategy

To realize our mission, we adopt a rather flexible exit strategy, such as selling to strategic or financial investors and initial public offering (IPO).